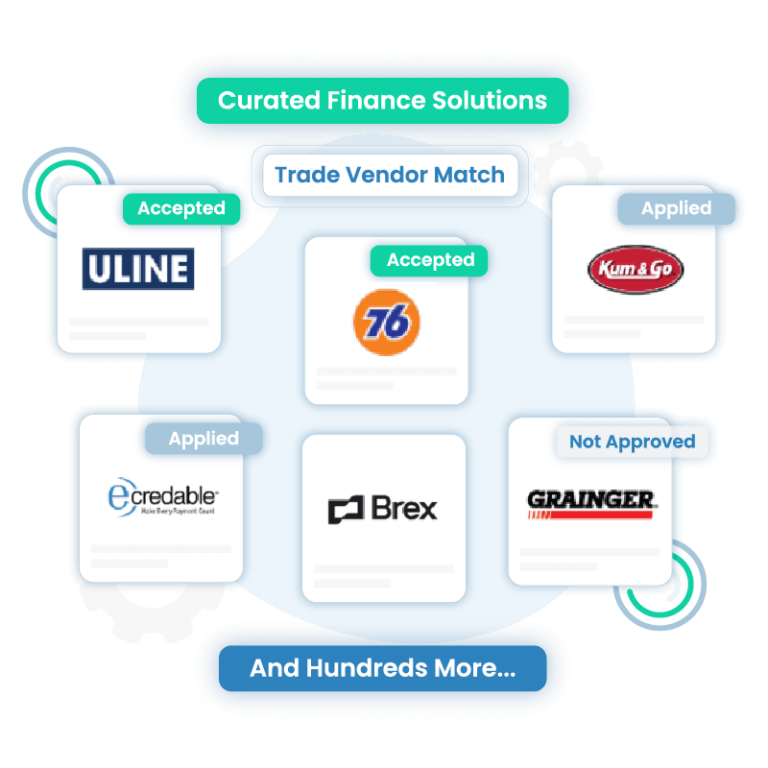

Fundability® helps you build business credit faster, secure maximum funding, access capital at lower rates and better terms, and even connects you with over 300+ funding sources—all in one easy-to-use platform

Step 1

With real-time insights into your business’s financial health, you’ll see how fundable your business truly is, what you qualify for now, and the exact steps to take to unlock even more funding in the future.

Step 2

Step 3

Step 4

Step 5

Copyright 2025 © OPM financial group. | All rights reserved.